Itaú Partiu!

Digital Products Postgraduate Program

Itaú Unibanco S.A.

Product Design

Figma

Miro

Google Forms

Illustrator

2024-2025

Beyond banking to connect people and cultural experiences across Brazil

The goal of this project was to connect Itaú’s financial ecosystem with a more democratic and personalized travel planning experience, creating a digital service that is both emotionally engaging and practically useful.

Problem

Although Itaú sponsors several major events in Brazil, a large portion of young people are unable to attend due to high travel costs. Expenses like transportation, lodging, and food form a barrier that, without proper financial planning, makes the trip unfeasible. Moreover, there was no existing platform that helped users plan and finance their trips in an integrated and personalized way.

User Research

To validate the problem and understand user behavior, I conducted a quantitative survey with 37 respondents and carried out netnographic research on social media. I asked users about their travel habits, financial barriers, and their current use of finance and travel apps.

Key findings included:

- 76% said they would use an app that helps with travel planning

- Cost of flights (40%) and accommodation (27%) were top barriers

- 45% reported not using any kind of finance organization app

These insights revealed a strong opportunity to offer a solution that simplifies financial planning while promoting access to cultural experiences.

Competitive Analysis

I benchmarked key competitors like Nubank Ultravioleta, C6 Carbon, PicPay, Banco Inter, and Santander Way. While most of them offer cashback, credit lines, or travel benefits, none are truly focused on travel planning + gamified savings. This created an opportunity to position Itaú as a distinctive player in this space.

Personas

Based on user data, I developed two key personas that represent the spectrum of needs:

Lucas, 24

The Festival Fan

“I see my friends traveling to festivals and I really wish I could go too, but I always lack the money or planning.”

- R$3,200/month income

- Loves festivals but lacks financial planning habits

- Prefers intuitive, hassle-free digital tools

Mariana, 29

The Explorer

“I really want to go to the festivals I see online, but everything is more expensive for those who live far from the big cities.”

- R$6,800/month income

- Lives far from major cities, which increases travel costs

- Plans ahead and seeks tools that support her regional context

User Journey

To ensure a human-centered experience, I mapped the full journey of a persona named Laura, from first seeing an ad for the service to post-event engagement.

Main stages:

- Discovery via social media

- Exploring features

- Setting financial goals

- Planning & gamified savings

- Booking with financing

- Attending the event

- Sharing the experience afterward

Each touchpoint was designed to balance utility, emotion, and brand alignment.

Key Features

Guided by research insights and feasibility, I prioritized the following features:

- Cost-of-living map based on destination and event

- Interactive financial AI assistant for planning with goal tracking

- Gamification system with challenges and rewards

- Travel financing simulator with accessible options

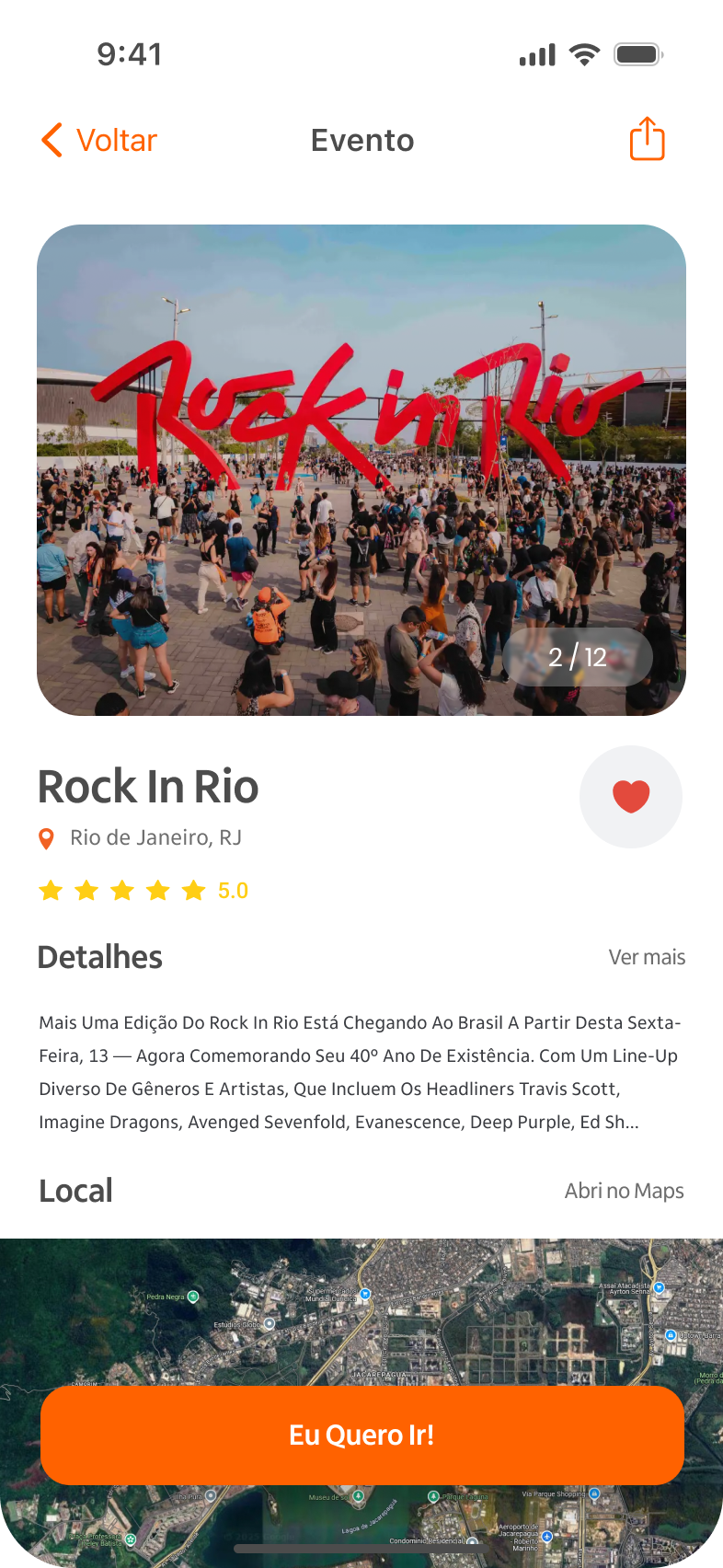

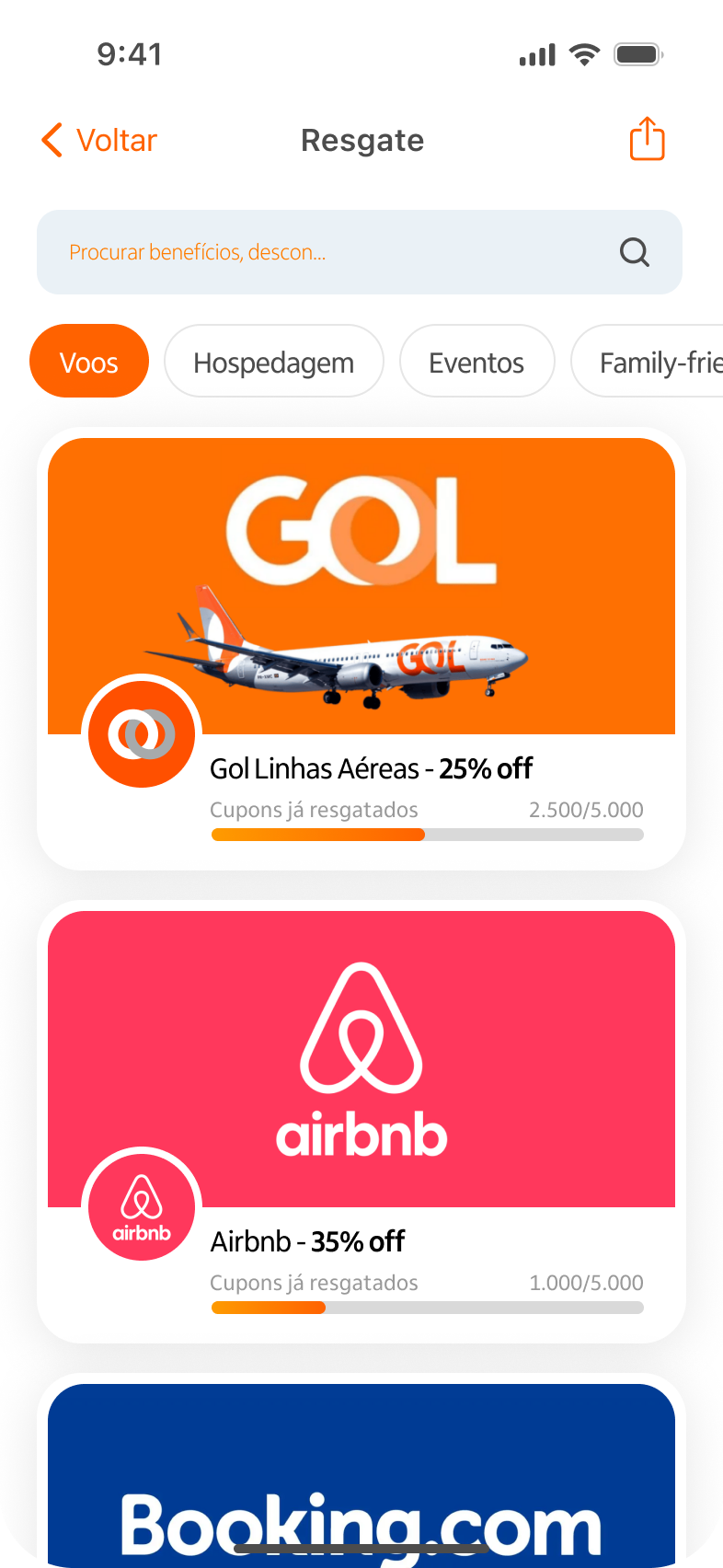

- Exclusive perks like discounts, cashback, and ticket benefits

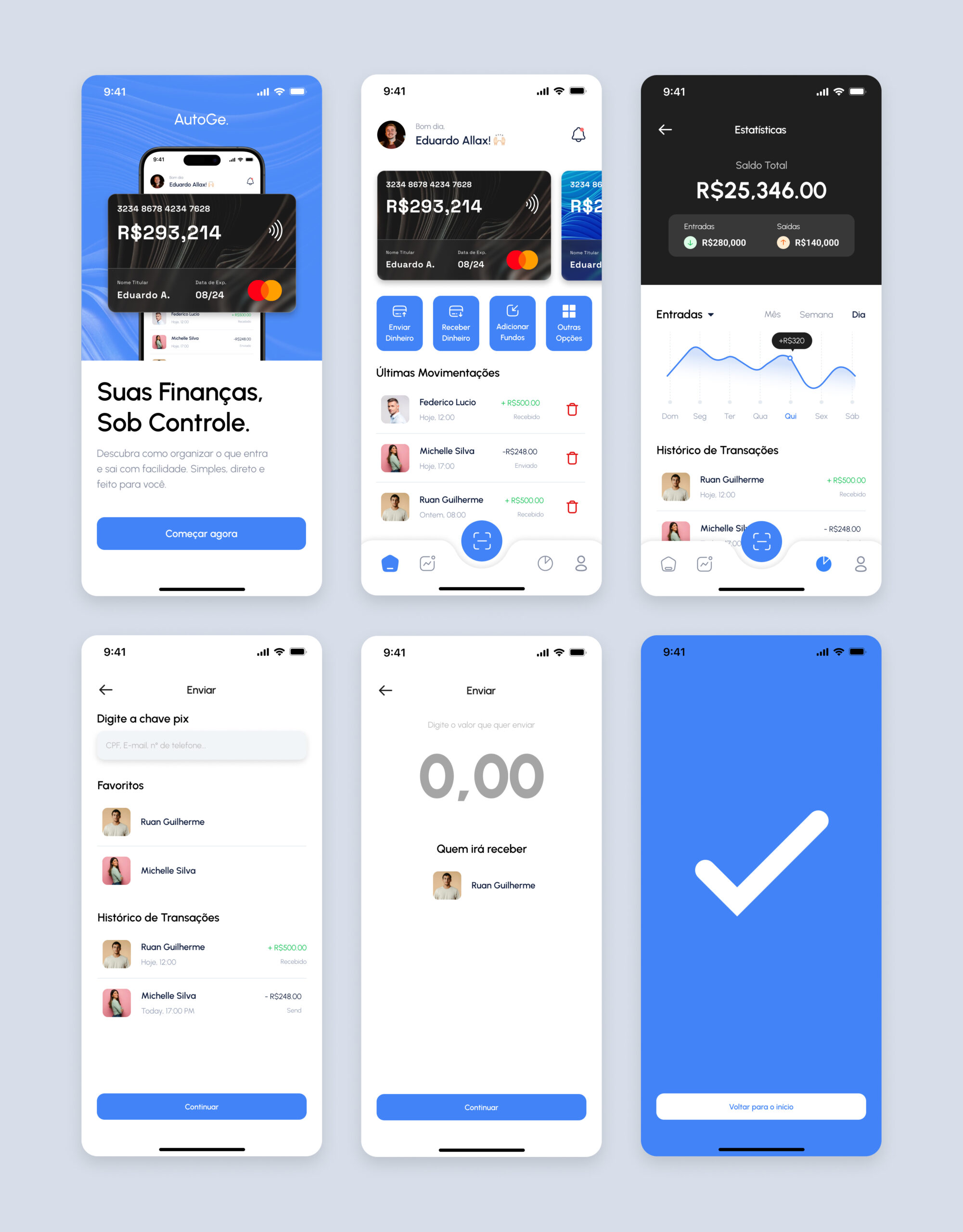

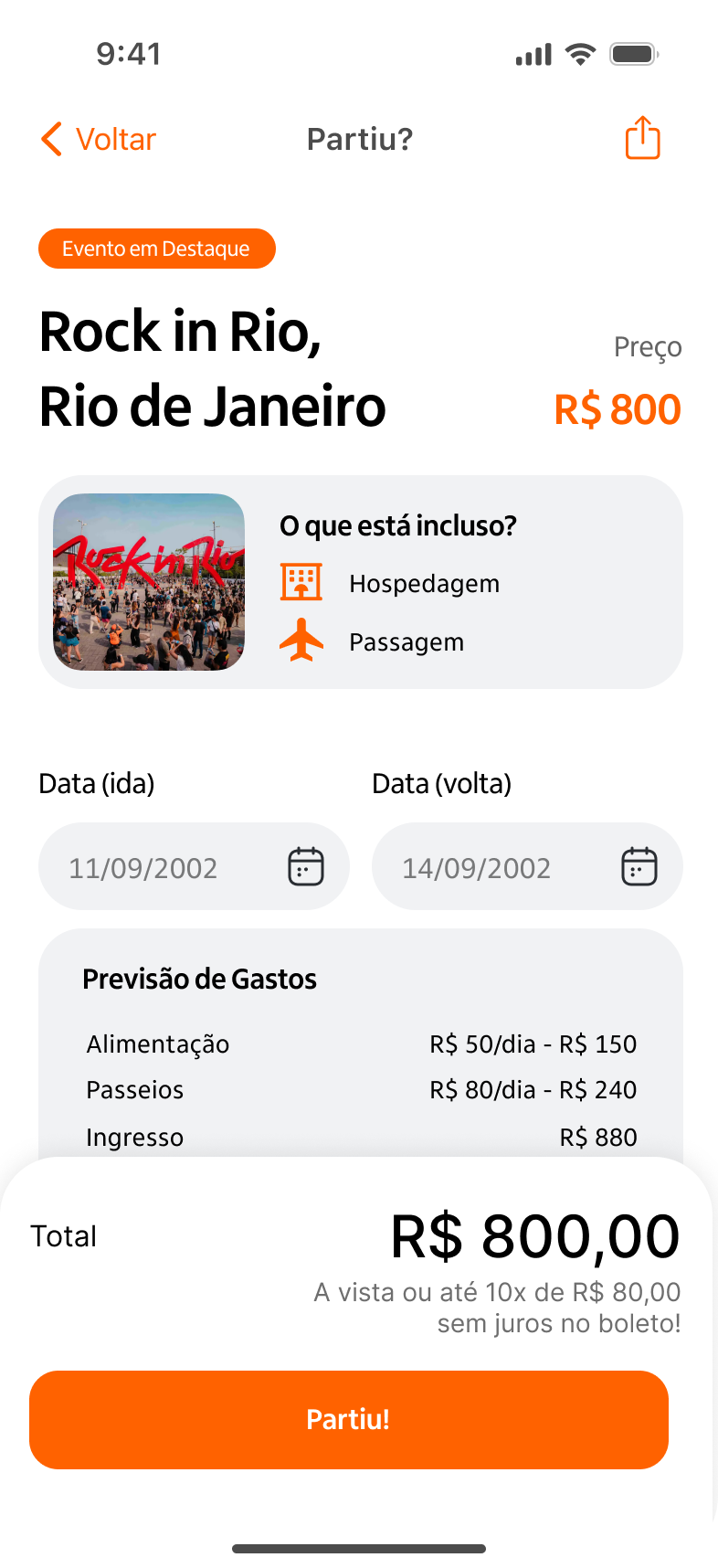

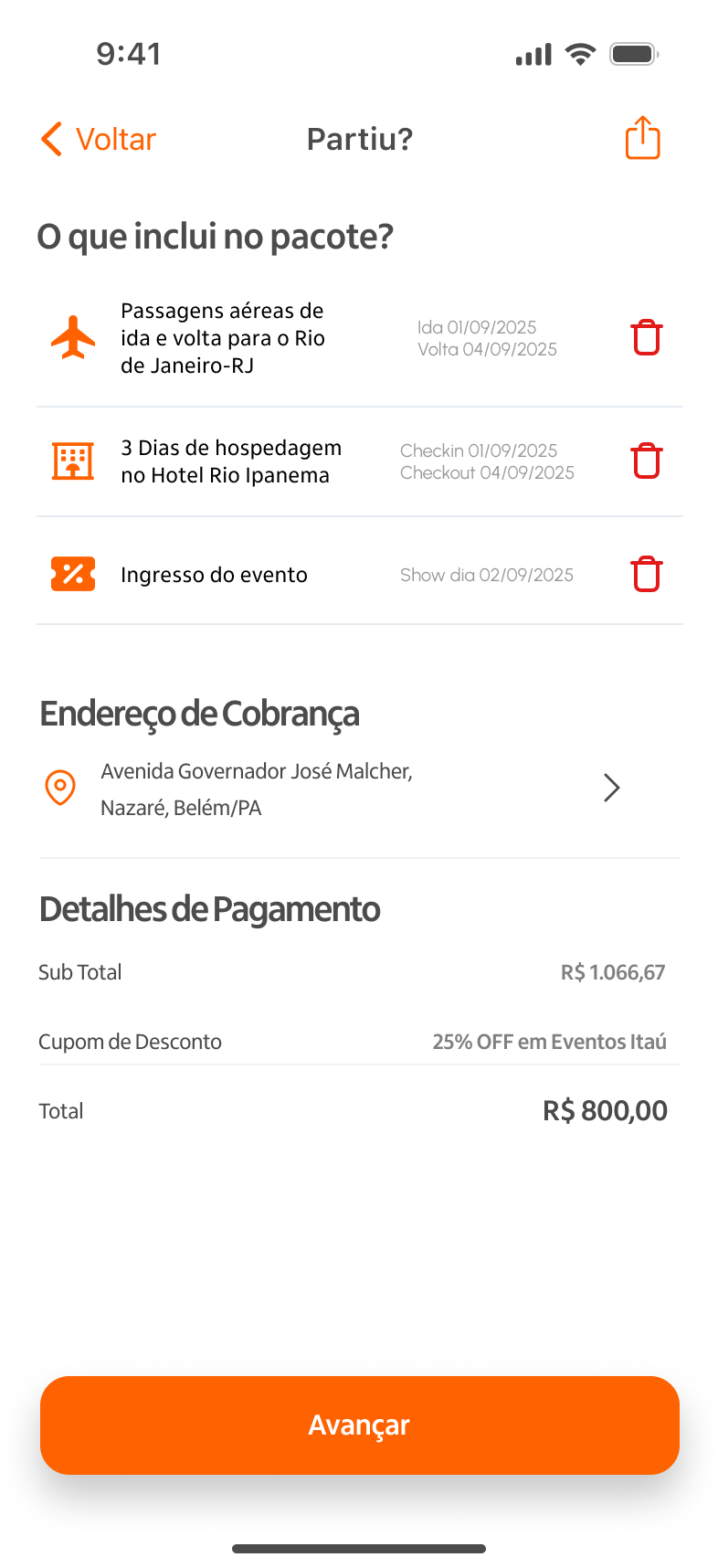

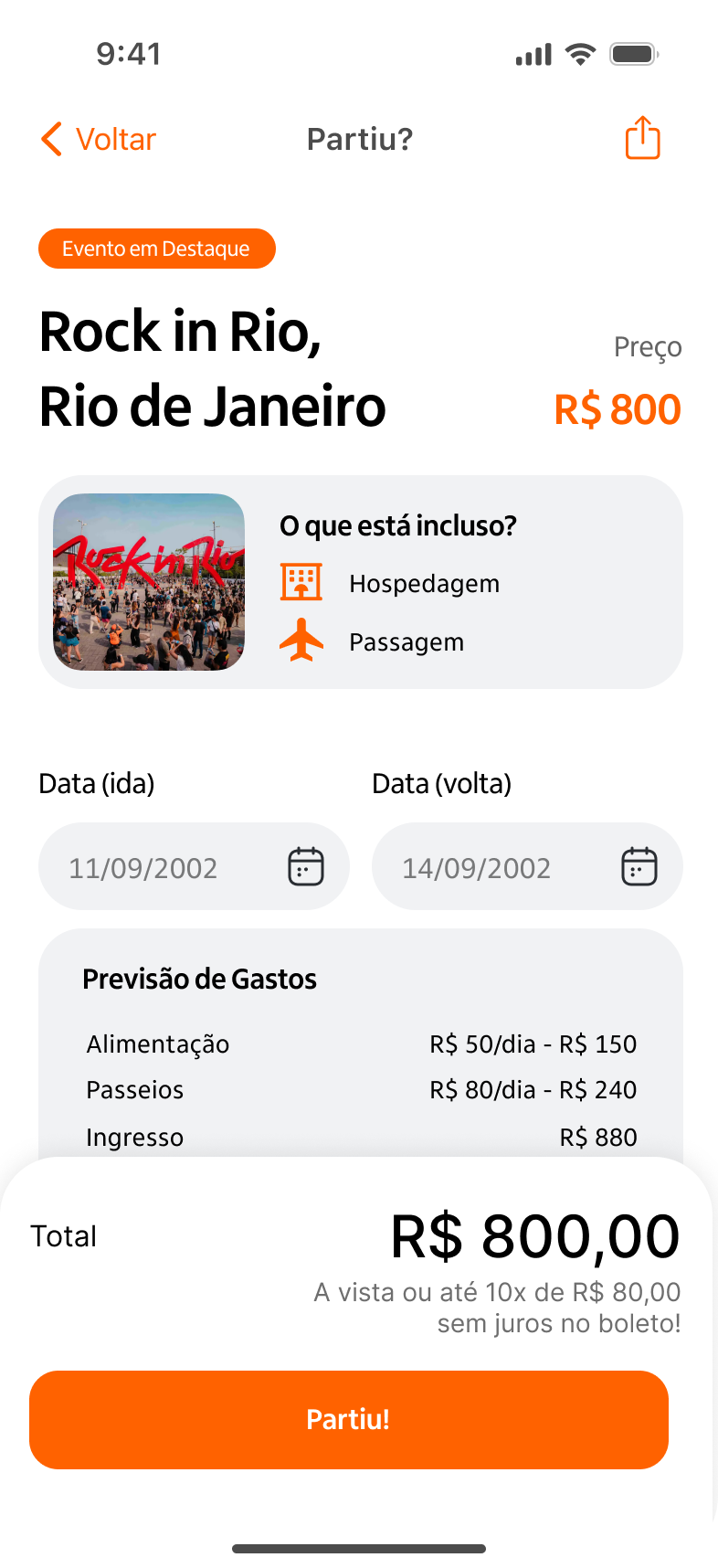

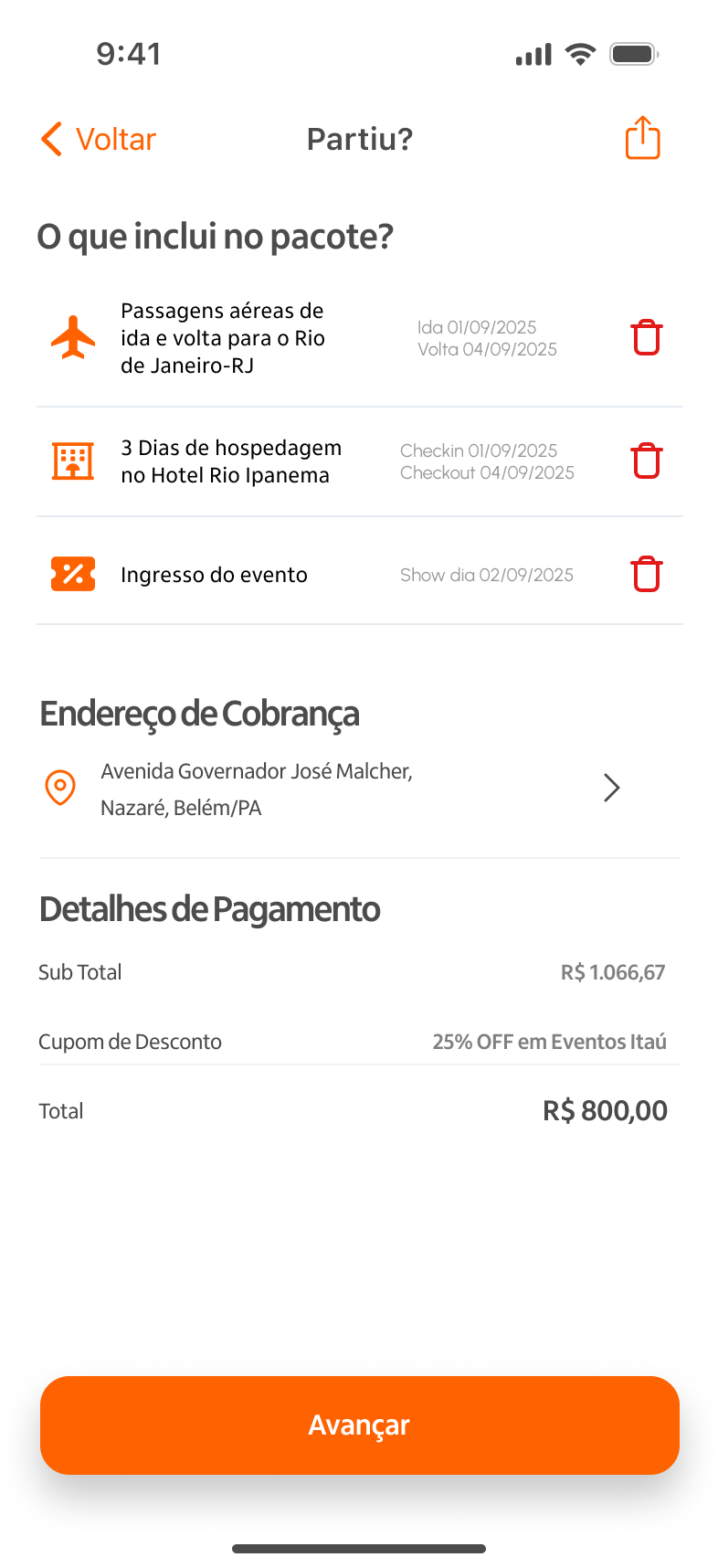

UI Design & Prototype

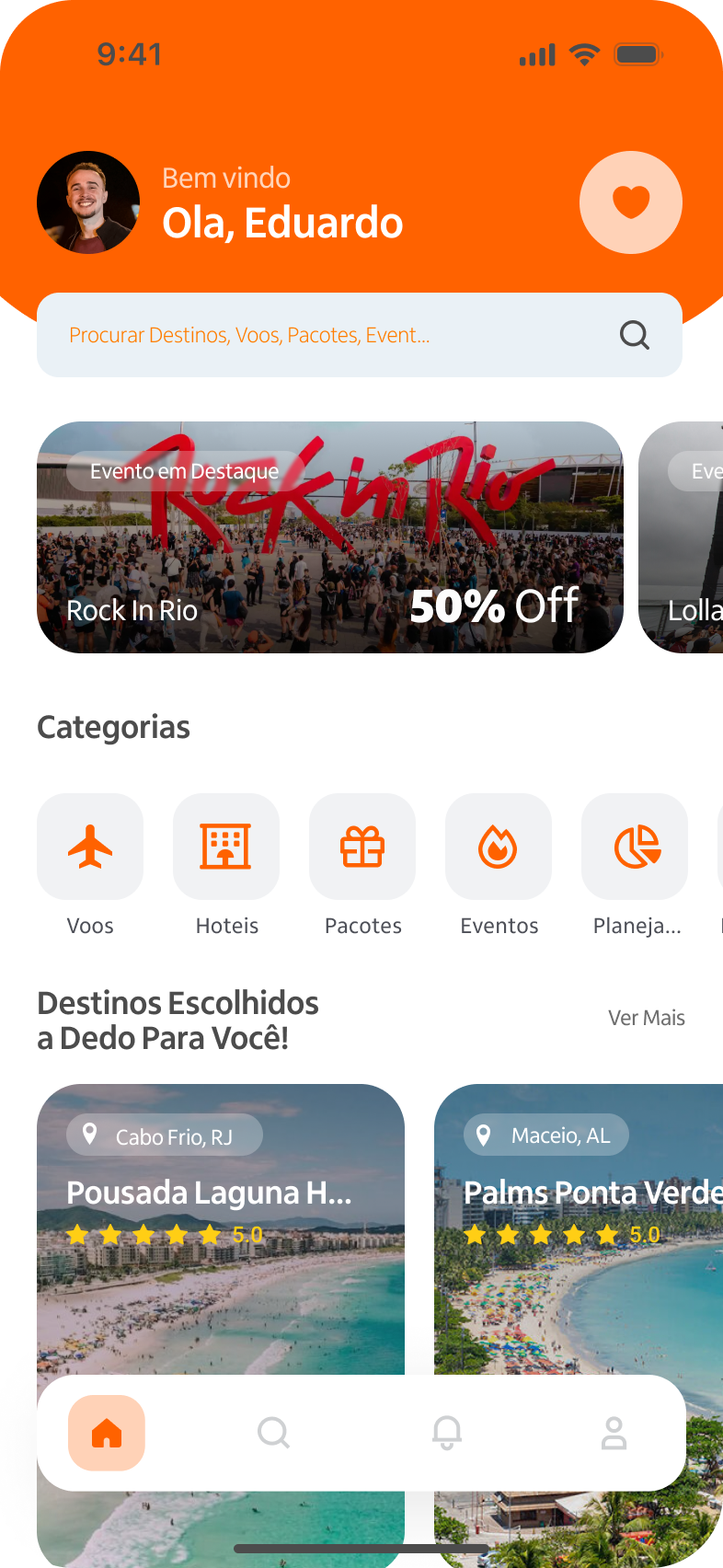

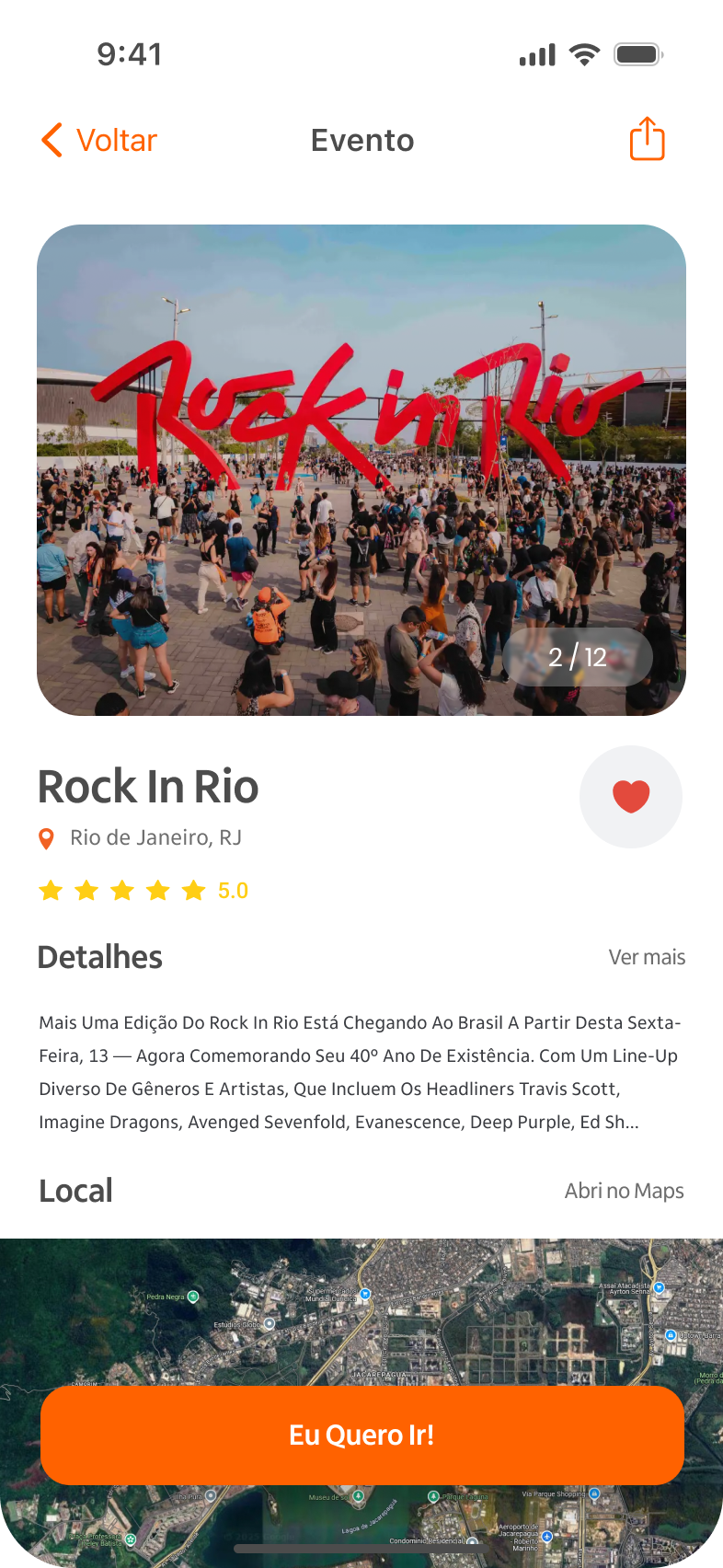

I designed a lightweight and intuitive interface using vibrant colors, clear icons, and warm illustrations to create emotional appeal. Navigation was built around three core moments: Organize, Save, and Go.

Key screens included:

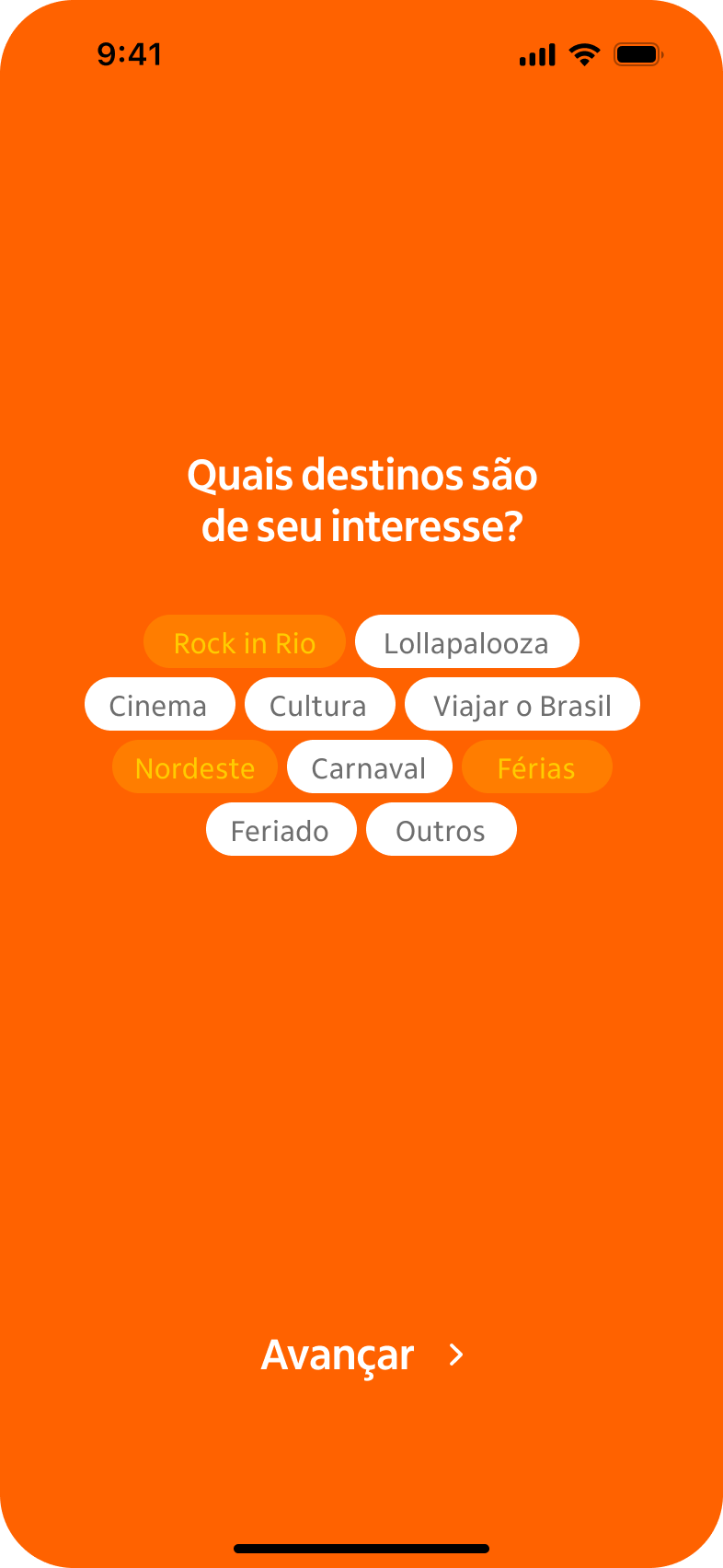

Onboarding flow based on user goals

Home screen with featured events and benefits

Budget planner with gamified tasks

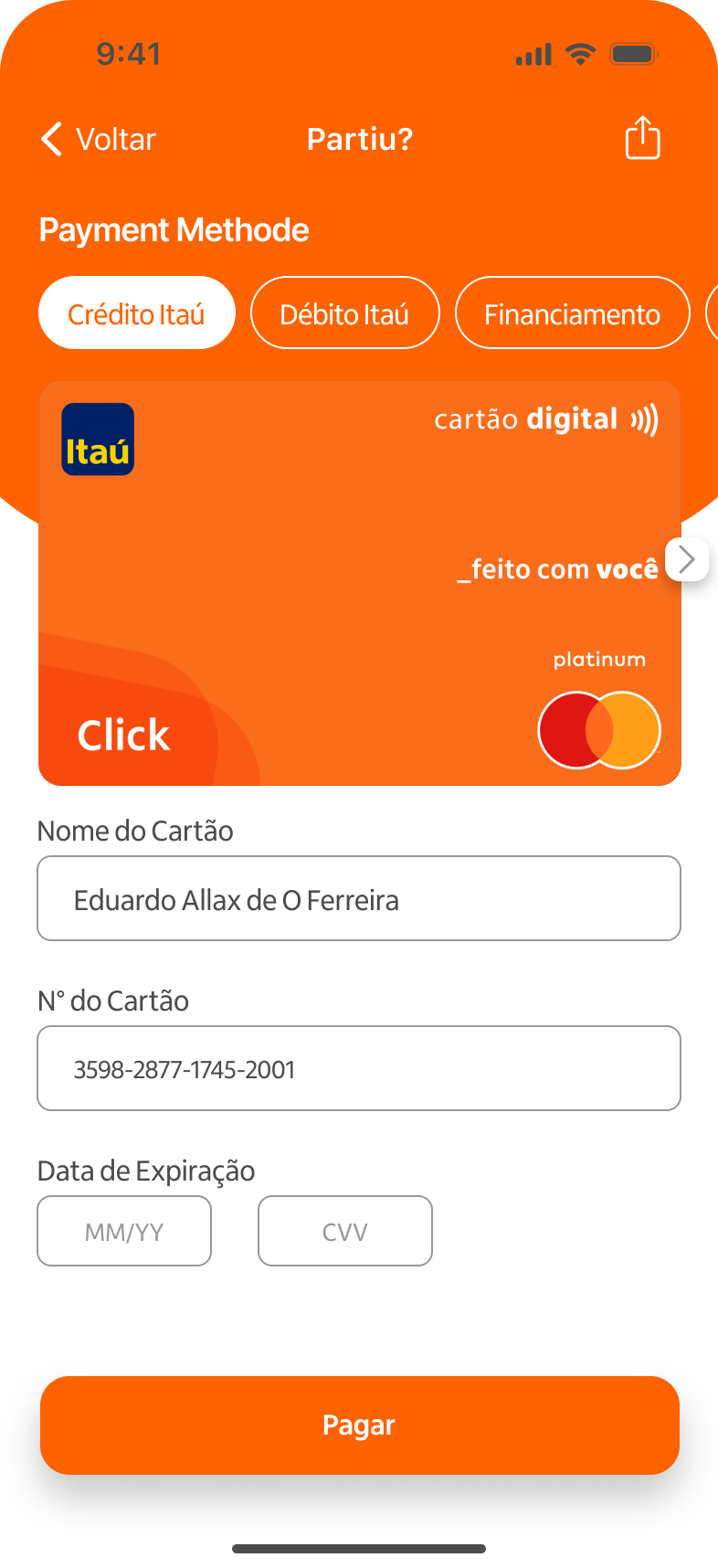

Checkout screen with financing options

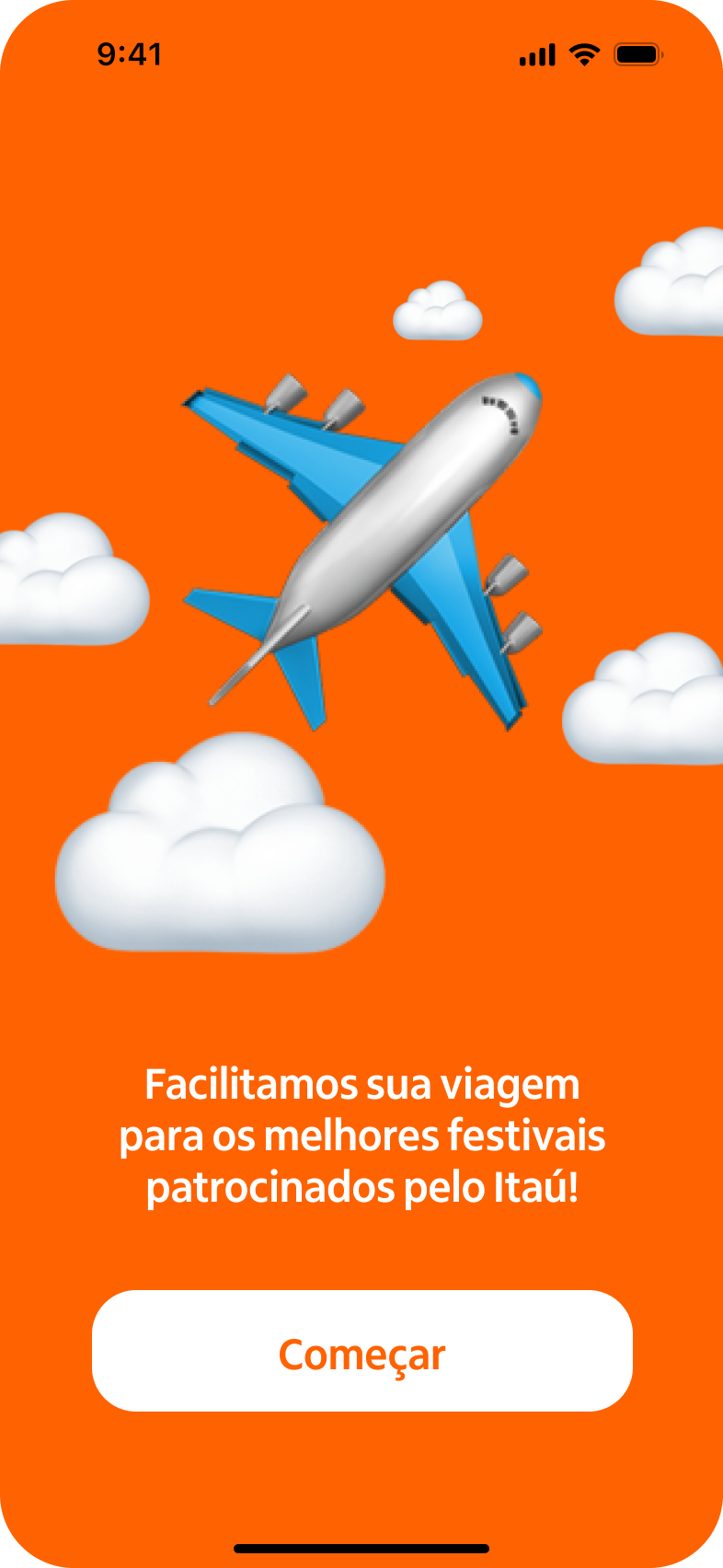

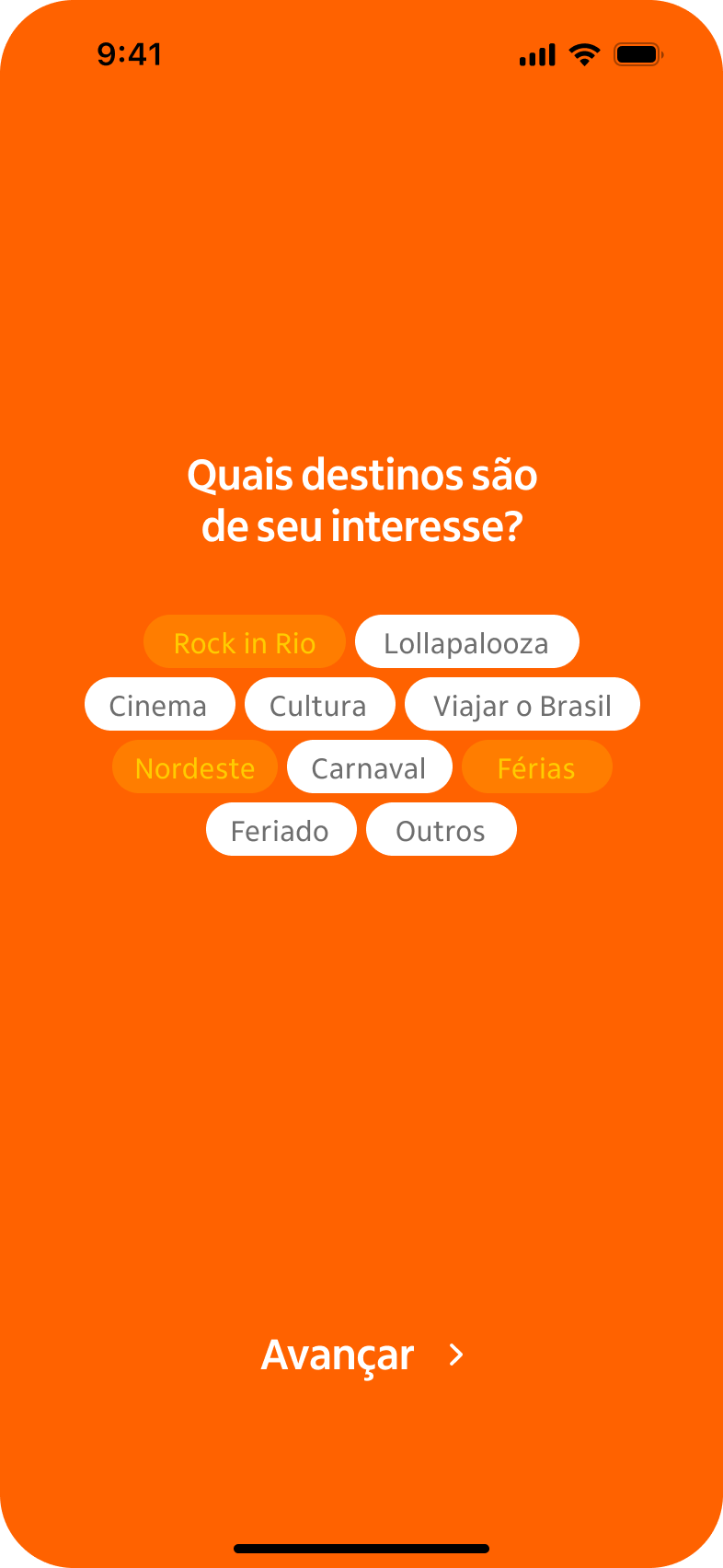

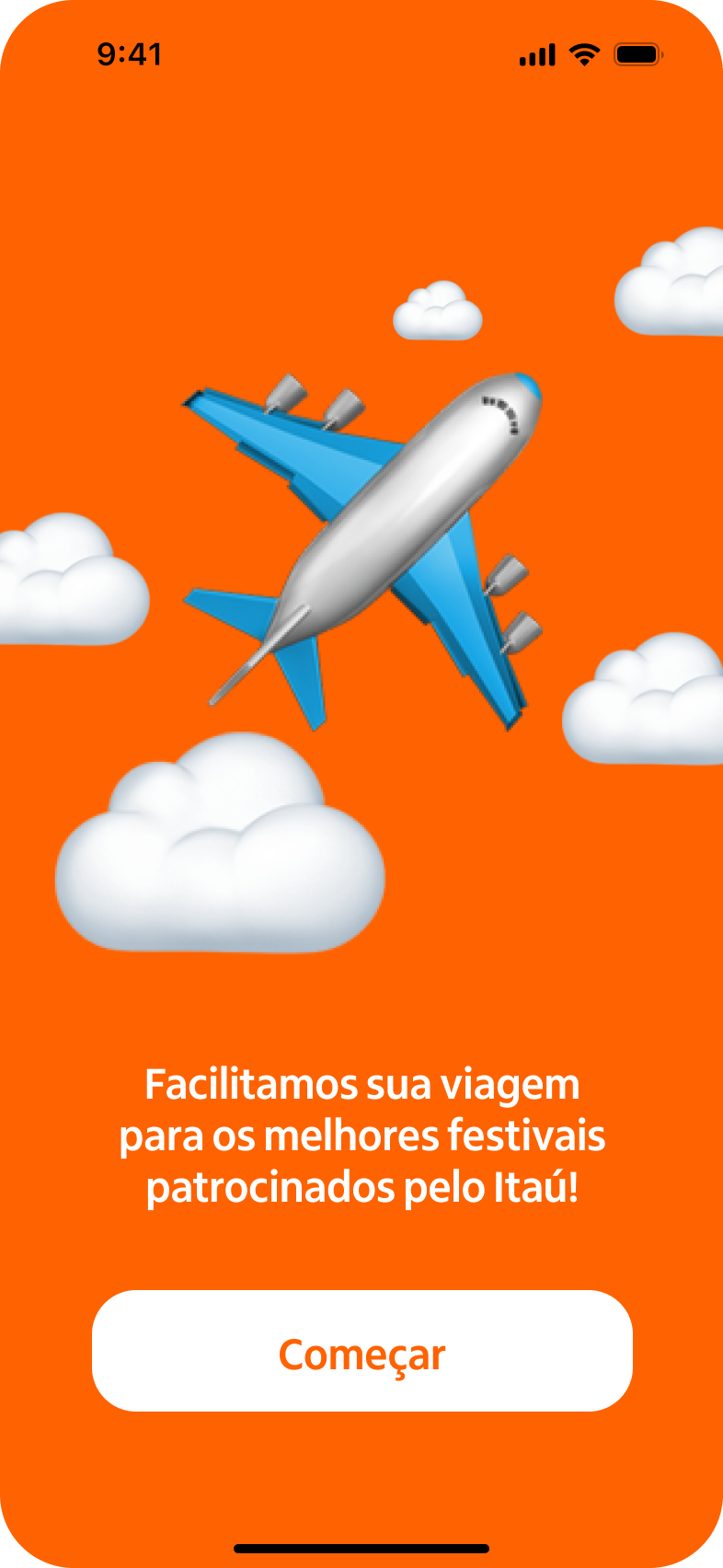

First Impressions Matter

The first contact with Itaú Partiu was designed to create an immediate emotional connection with the audience. The onboarding screens were crafted to better understand each user’s profile while engaging them from the very beginning, encouraging more active participation in the program.

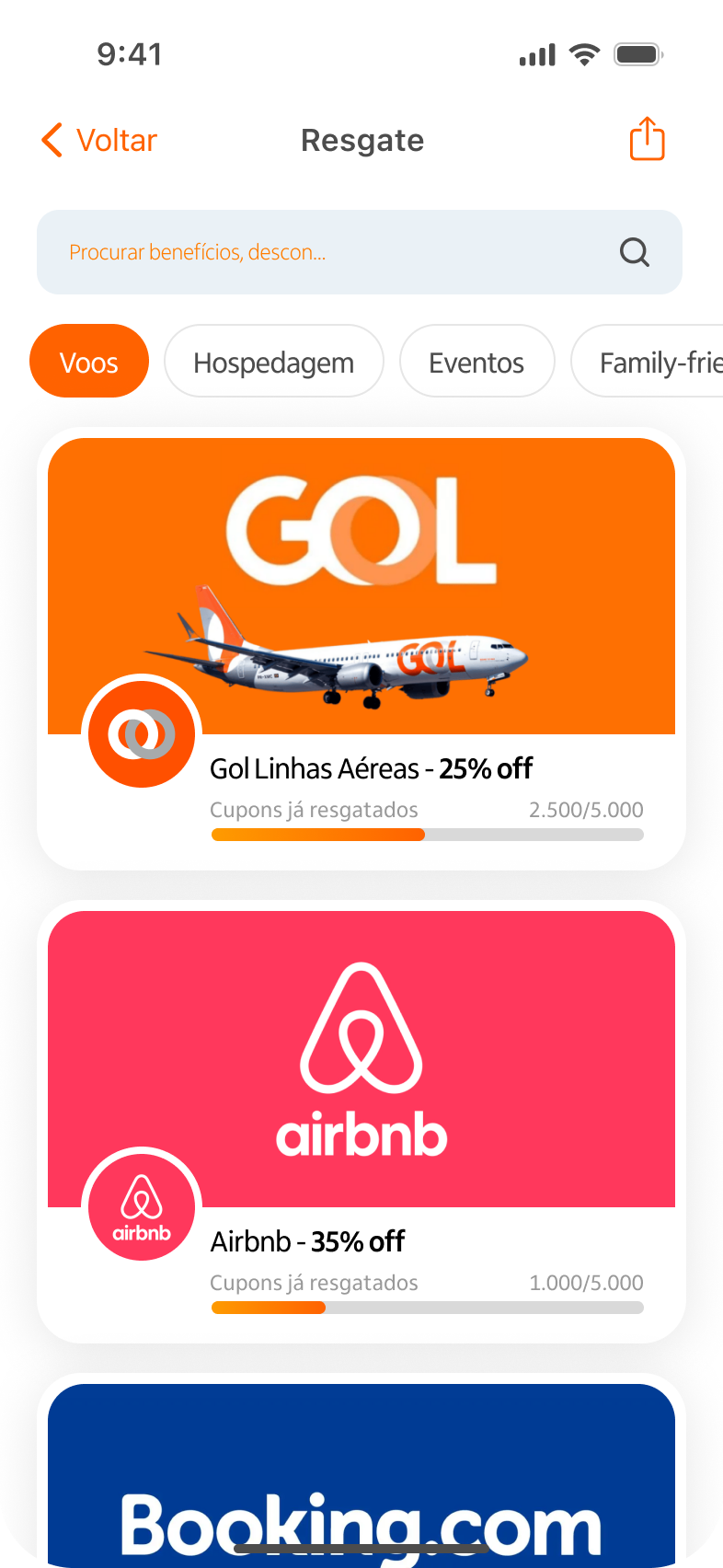

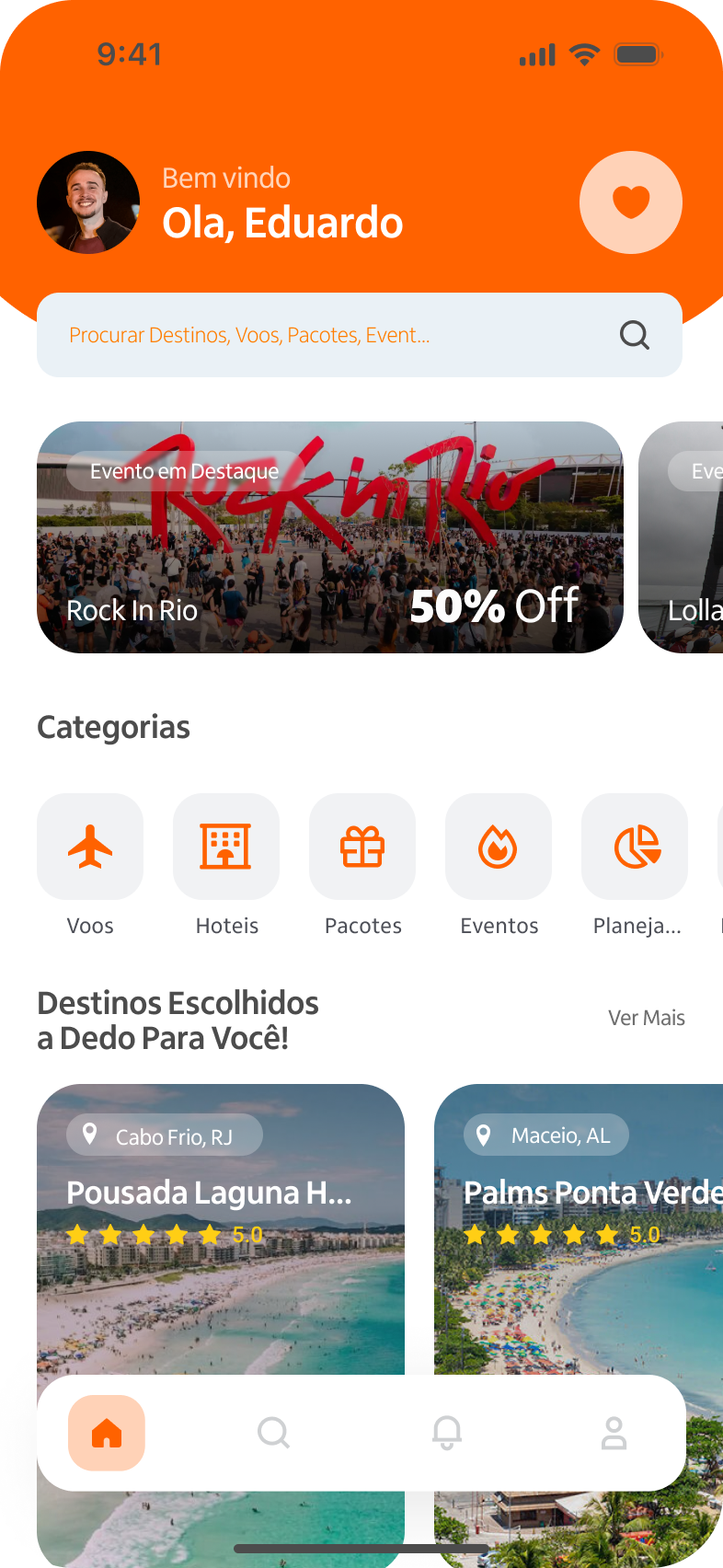

Explore and Discover

The home screen offers a light, visually pleasant, and intuitive navigation experience. Here, users can find the main festivals sponsored by Itaú, including some they might not have discovered otherwise. There’s also an exclusive benefits area with discount coupons, cashback offers, and other perks, making the overall experience even more accessible and rewarding.

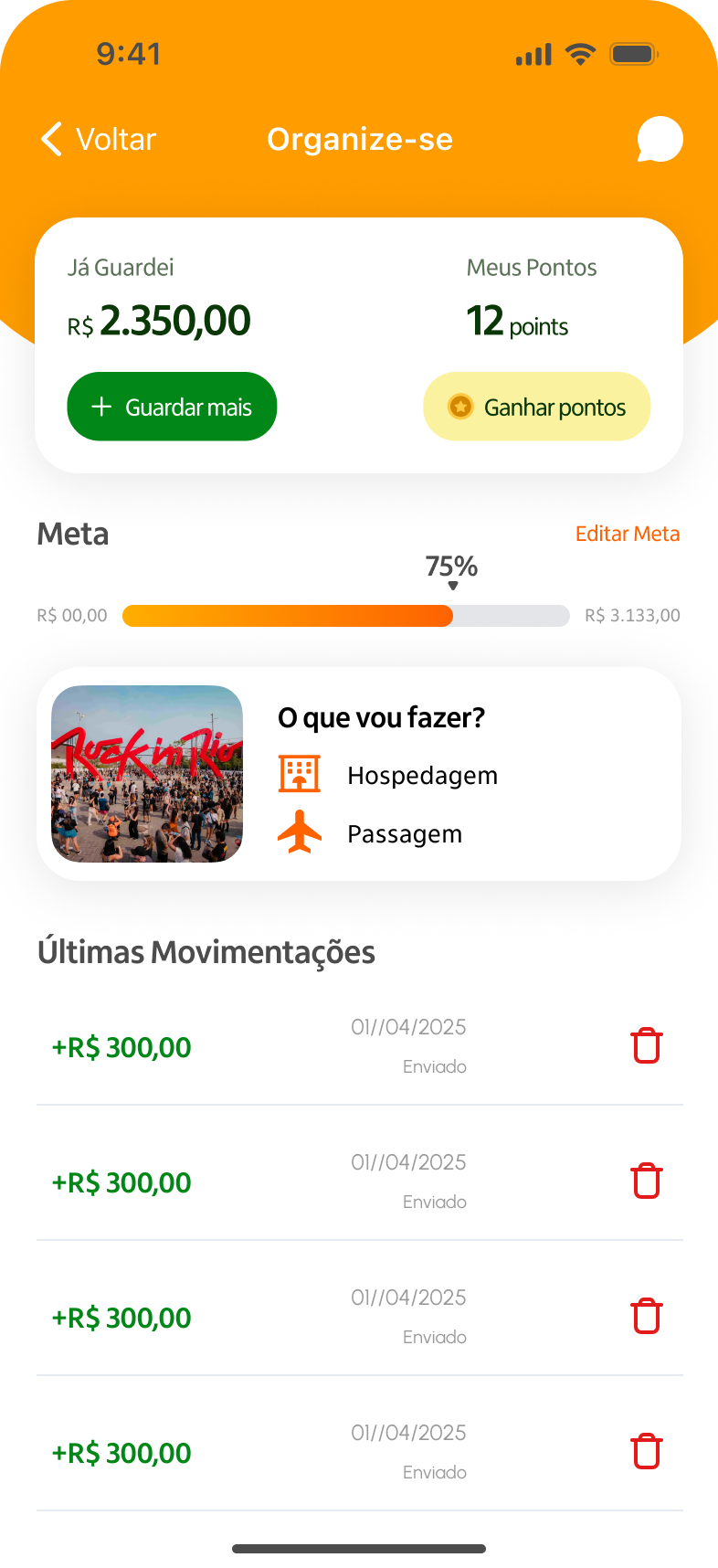

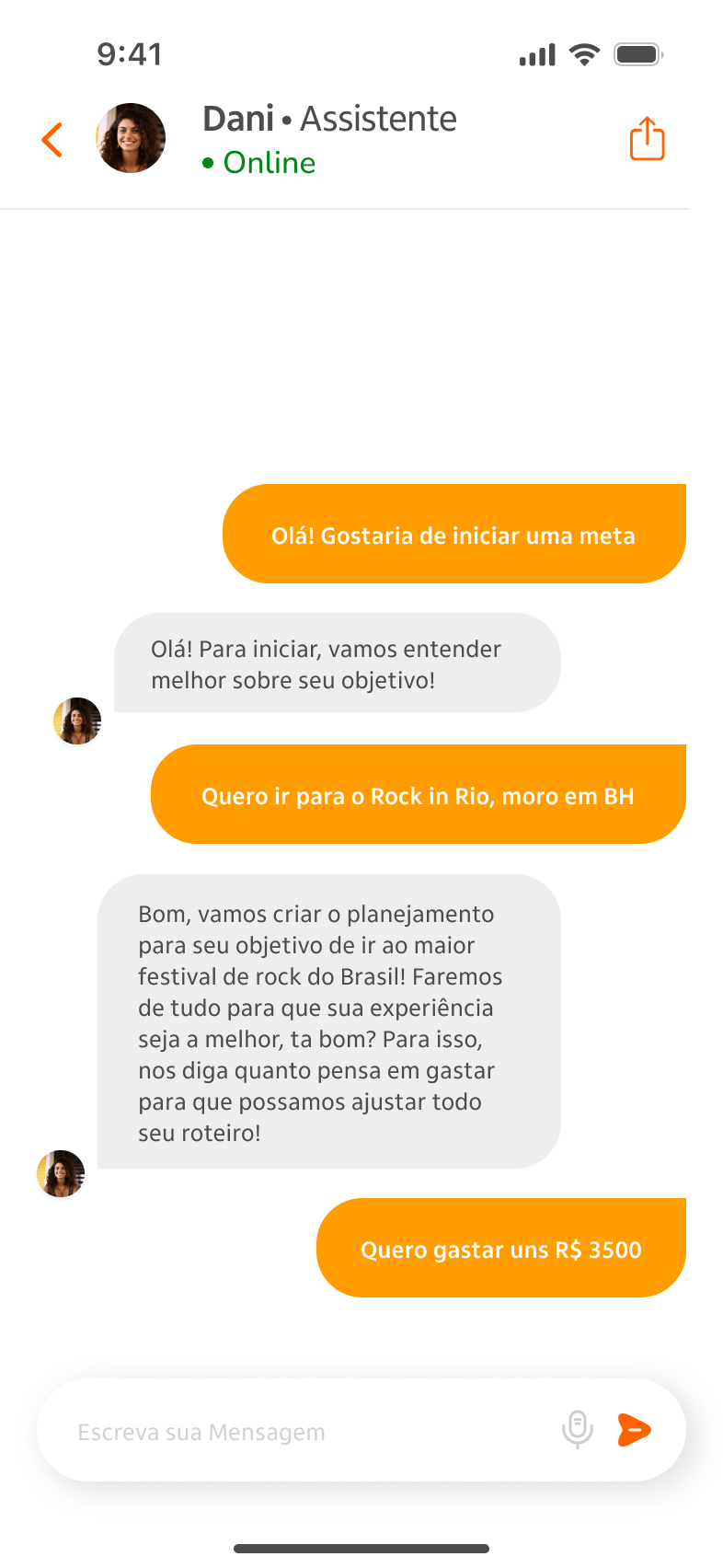

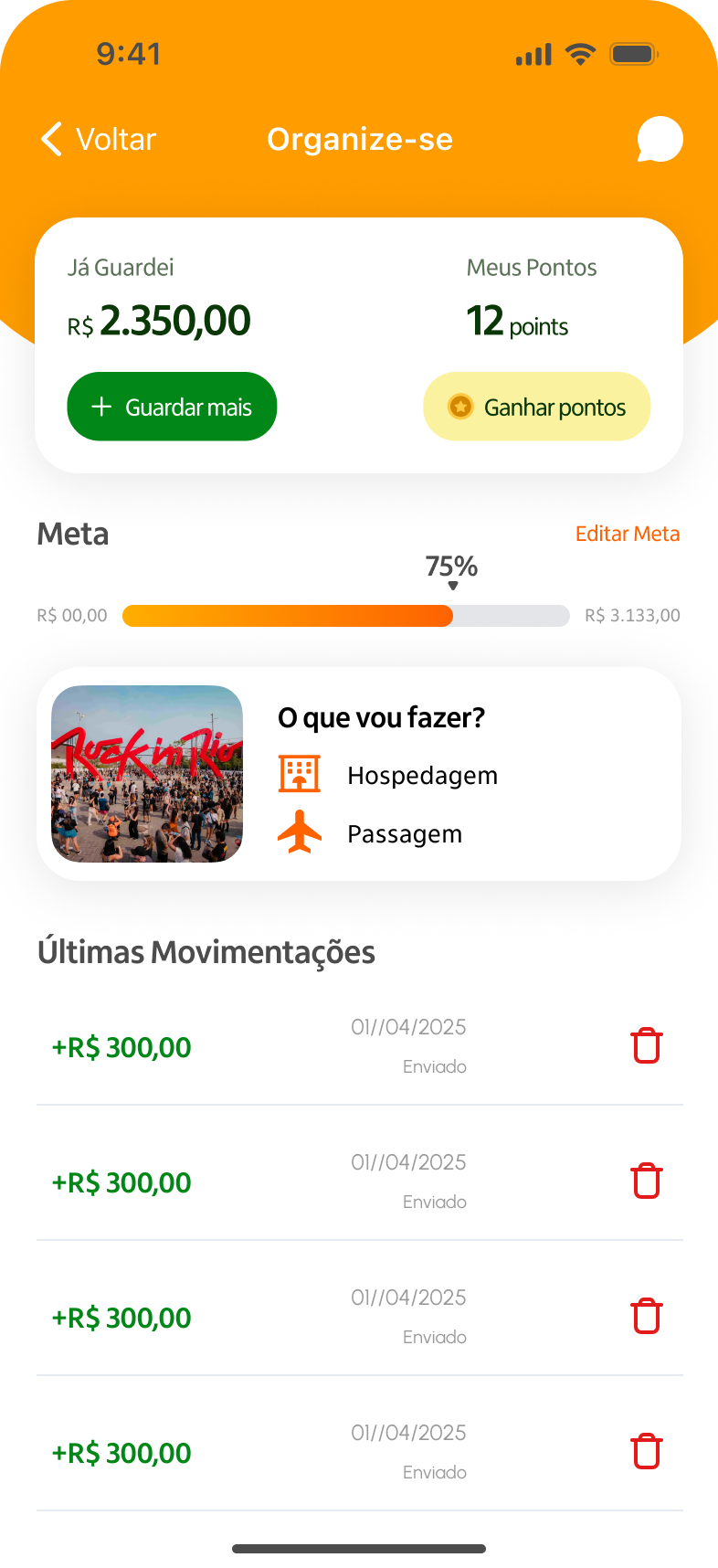

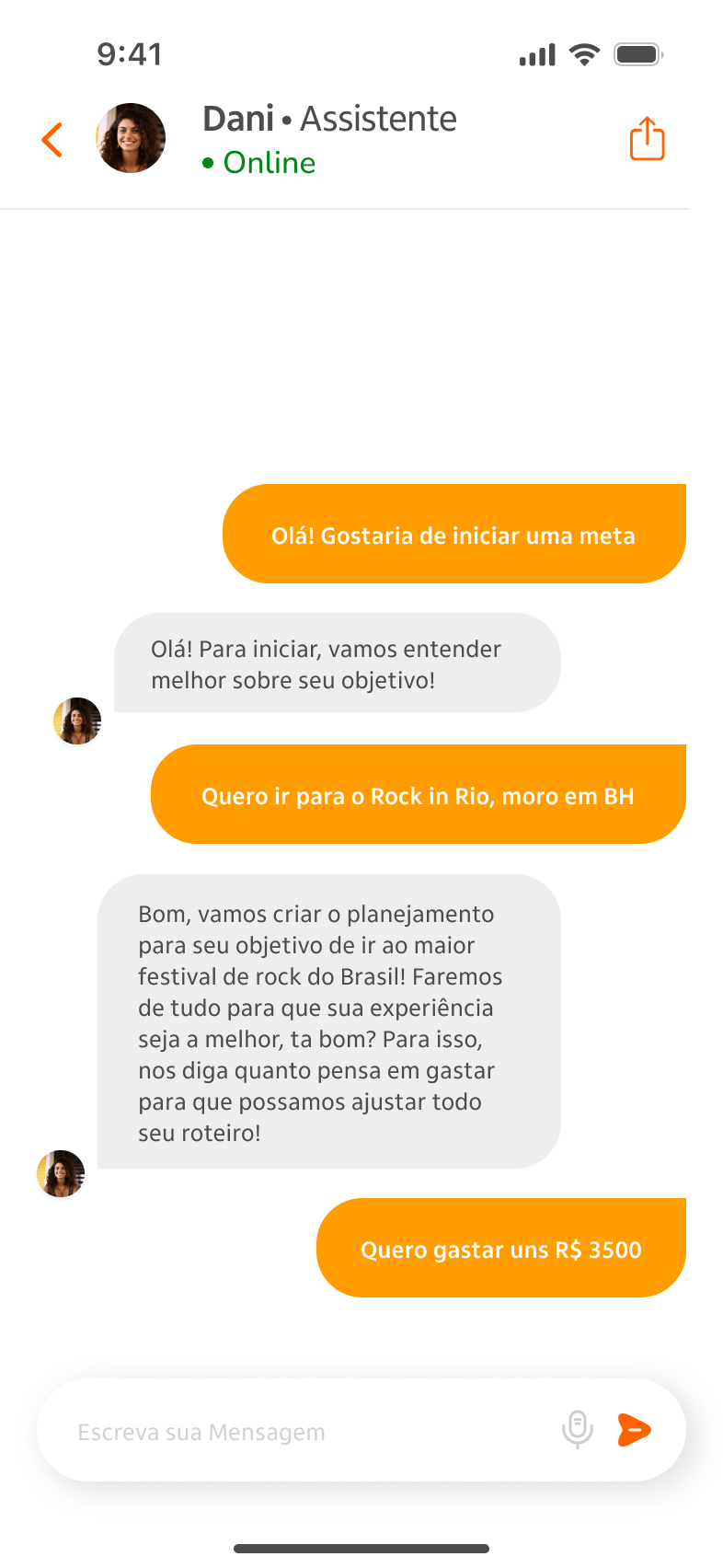

Plan, Play, and Save

This is the heart of Itaú Partiu, where innovation meets personalization. Users have access to a dedicated financial planning area specifically designed for travel, featuring gamified elements such as missions and achievements to motivate savings. An AI-powered virtual assistant supports users by helping them organize their finances, answering questions, and offering personalized tips.

Checkout with Confidence

The checkout flow was built to be simple, fast, and accessible. Its standout feature is the option for bank-financed travel, making it ideal for users who struggle to save money ahead of time. It’s a practical solution designed to make travel possible for everyone, regardless of their current financial situation.

Expected Outcomes

Although this was an academic project, expected outcomes for a real-world implementation would include:

Higher adoption of trip financing among young Itaú clients

Reduction in trip dropouts due to financial planning issues

Increased engagement with Itaú-sponsored events

Improved brand perception as a youth-friendly cultural enabler

Learnings & Next Steps

This project taught me the importance of combining quantitative insights with deep empathy. The research phase transformed a broad idea into a focused product vision with real impact. In a next iteration, I would validate the prototype with real users, test gamification effectiveness, and explore integration with actual bank data to simulate financing in real time.

The complete project development and rationalization process (in Pt-BR) is available at this link.